Centralized Power, Decentralized Accountability: Jeremy and the non-existent Incident Response Team

"The choice for mankind lies between freedom and happiness, and for the great bulk of mankind, happiness is better"

ZachXBT, the one and only savage blockchain detective, recently posed a pointed question to Circle, the issuer of USDC, via X, specifically at Jeremy Allaire:

https://x.com/zachxbt/status/1866783689876574437

“Why does Circle always deny helping victims in large exploits/hacks in clear-cut cases of illicit funds as a centralized issuer? Is your incident response team nonexistent?”

This public critique highlights Circle’s very apparent reluctance to intervene in high-profile hacks and exploits where illicit funds are often easily identifiable. As a centralized issuer, Circle holds the power to freeze or blacklist USDC tokens, yet it almost always refrains from acting. You can only wonder about Circle’s approach to incident response and what the future implications are for the(ir) stablecoin ecosystem.

Centralized Stablecoin Issuers in Crises

Circle operates in a unique position within a decentralized financial ecosystem. While they are blockchain-based, their centralized nature grants issuers control over key aspects, such as the ability to freeze or seize funds. This control can be both a strength and a weakness, depending on how it is wielded.

Tether, Circle’s main competitor, has frequently stepped in during crises. Whether it’s freezing $33.5 million in USDt linked to the 2022 Ronin Bridge hack or halting stolen funds from the KuCoin exploit, Tether’s rapid actions have earned it a reputation for pragmatism. While it might be triggering for supporters of decentralization, it has generally increased trust among traders and exchanges, even as critics argue it sets a precedent for overreach.

Circle, on the other hand, emphasizes “regulatory compliance” and “transparency.” Its hands-off approach signals a reluctance to act without explicit directives from law enforcement or regulators. While this aligns with its branding as a trusted, compliant issuer, it frustrates users who expect Circle to take a more active role in protecting the ecosystem.

So what is Circle’s Incident Response Framework Really?

The absence of visible interventions in clear-cut cases of illicit funds raises questions about Circle’s internal processes:

Circle’s decisions to freeze funds often seem reactive, relying on external requests rather than proactive monitoring and response. This contrasts clearly with Tether’s willingness to act fast based on community or exchange reports.

Circle’s focus on compliance over action will stem from its institutional partnerships, the US government being its daddy, and reliance on maintaining a reputation for regulatory alignment. Intervening in hacks without formal orders could expose Circle to legal and reputational risks. Maybe they should rebrand to “government coin.”

ZachXBT’s question about the existence of an incident response team points out a clear gap in Circle’s operational infrastructure. If such a team exists at all, its lack of visibility during major exploits is very notable.

On the Ethos of Censorship and Control

Circle’s power to blacklist and freeze funds places it in a unique position of authority within a decentralized financial system. This authority brings up ethical and operational questions:

Frequent intervention risks positioning Circle as an arbiter of financial transactions, which may conflict with the ethos of decentralization. By refraining from acting in certain cases, Circle avoids accusations of overreach but risks being seen as indifferent to user protection. They take no issue coming across as indifferent.

The ability to control funds should come with a clear framework for accountability. Circle’s lack of transparency about its decision-making process creates uncertainty about when and how it will act.

The Jeremy Allaire Critique

Jeremy Allaire often champions the role of USDC as a trusted, compliant stablecoin. As with this new Binance partnership announcement. However, as ZachXBT’s critique points out, this narrative is at odds with user expectations. The community values rapid action in the face of crises, particularly when funds are traceable. Allaire’s silence on these matters only fuels skepticism about Circle’s priorities.

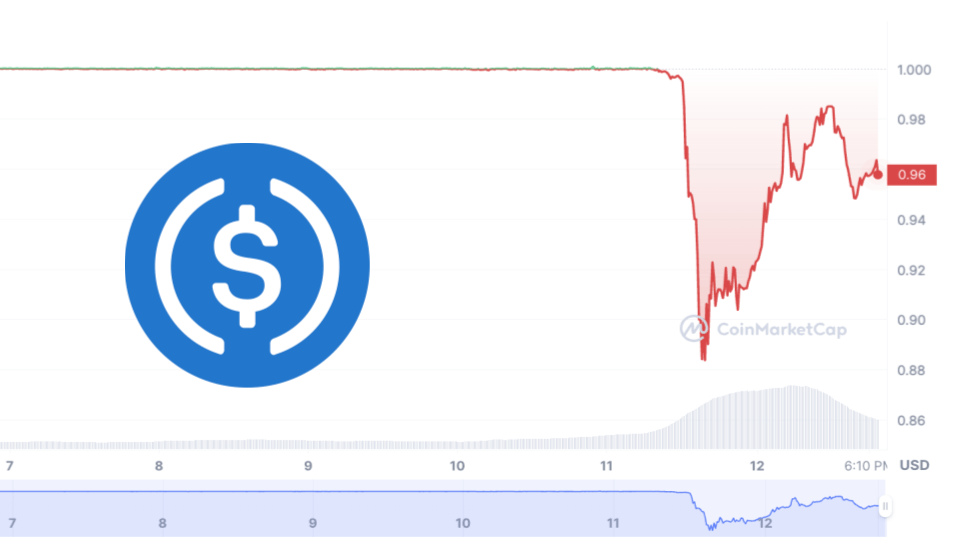

The issue is further complicated by USDC’s vulnerability during stress tests, such as the brief de-pegging incident early 2023, which highlighted potential risks in Circle’s operational framework. While it regained its peg, ever since the event raised questions about its resilience under pressure and its ability to maintain trust in uncertain times. Many panic-sold for a loss that day.

Implications for a “Stable” Ecosystem

Circle’s reluctance to act alienates its user base, particularly retail who rely on USDC for security and stability.

Tether’s proactive approach to incident response strengthens its position as the stablecoin of choice for traders and exchanges. Circle’s passivity cedes market share to its rival.

Circle’s approach may align with its regulatory commitments, but it definitely raises questions about the effectiveness of compliance-focused strategies in addressing real-world challenges.

A Call for Transparency

ZachXBT’s tweet reveals the need for greater transparency from Circle regarding its incident response framework. As a centralized issuer, Circle holds significant power over its ecosystem. With that power comes a responsibility to act in the best interests of its users and the broader crypto community.

While Circle is simping for regulatory alignment, it must balance this with the need for decisive action in crises. The stablecoin wars between Tether and Circle are not just about market share; they’re about trust, accountability, and the role of centralized issuers in a decentralized world. Until Circle addresses these concerns, questions about its commitment to the community will persist.

I love stablecoins, Tether in particular, and I will be writing about the ongoing and ever-increasing future stablecoin war. Stay tuned for insights, drama, and analysis as it all unfolds.

P.S. In case you didn’t realize, I am not Patrick Hansen.