MiCA Compliance and Tether: What’s Really Happening?

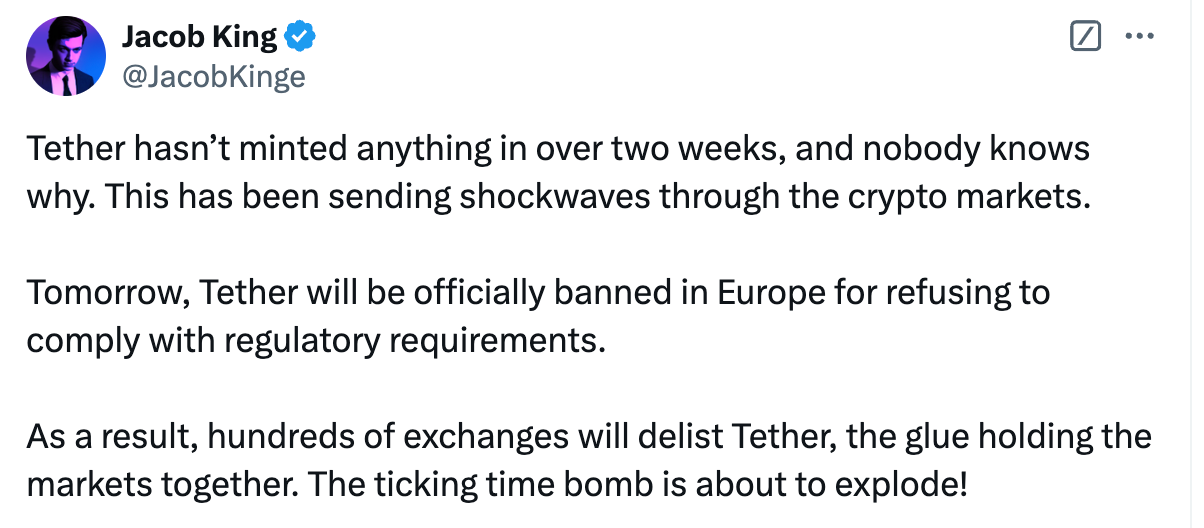

Like most bait on Twitter, Jacob King's tweet about Tether being banned in Europe and delisted from exchanges due to MiCA noncompliance is speculative and incorrect in its implication of a massive and immediate market collapse.

This bait, dramatic in tone, sparked some debate. While it highlights potential concerns regarding Tether’s position under the new European MiCA regulations, it lacks nuance, is bait, and presents a flawed conclusion. O, and it’s bait. Here's why.

Is Tether Being Banned in Europe?

No. MiCA regulations, which aim to bring transparency and governance to the crypto market, mandate compliance for stablecoin issuers operating within the EU. Tether has yet to achieve full MiCA compliance, leading to exchanges like Coinbase delisting USDT for European customers. However, major exchanges such as Binance, Kraken, and Crypto.com continue to support Tether, even as the MiCA framework’s final deadlines loom. They are also investing in plenty of MiCA-compliant proxies all over Europe.

Jacob King’s claim of a full “ban” misrepresents the situation. Tether is not prohibited from operating in Europe; rather, it faces restrictions in specific jurisdictions where exchanges like Coinbase choose to enforce stricter interpretations of MiCA rules because they are pussies.

“Europa’s” Loss

In Greek mythology, Europa was a Phoenician princess from Tyre and the mother of King Minos of Crete. Today, Europe enforces attached bottle caps.

A comment under King’s tweet resonates deeply:

This sentiment is worth unpacking. Tether’s dominance as the largest stablecoin globally, in those delicious emerging markets, positions it as a number one 4D chess player in the tech economy. While MiCA aims to protect consumers and standardize regulations, when in actuality it’s the EUSSR, and they are poor as shit, and they need to extract money from wherever they can, they simultaneously risk alienating founders, builders and anyone inclined towards tech, including tether which currently serves over 330 million on-chain wallets globally. The Eurozone’s inability to retain Tether’s full presence will drive capital flows toward regions with friendlier regulatory climates, such as the United States or Asia. Especially now Trump is on board.

A US Pivot?

As you know by now, Tether buys U.S. Treasury bills; there is no reliance on Europe. As Tether CTO Paolo Ardoino has repeatedly emphasized, USDT primarily serves the unbanked in Latin America, Southeast Asia, and Africa; markets less impacted by European regulatory decisions.

Interestingly, some analysts view Tether’s regulatory stance as preparation for alignment with a future U.S. administration that may favor crypto. By solidifying its reputation as a trusted and compliant issuer in the U.S., Tether could position itself to benefit from a more crypto-friendly regulatory environment in one of the world's largest markets.

Implications for the Stablecoin Market

Even if exchanges in Europe delist USDT, its dominance across other regions ensures limited impact on its overall market cap and liquidity. Tether’s wide adoption on TRON, Ethereum, TON and other chains fortifies its position

By potentially sidelining Tether, Europe risks stifling innovation in its digital asset ecosystem. This will widen the gap between the EU and the U.S., where regulatory approaches better accommodate stablecoin issuers. But yeah, the bottle caps look great

If Tether pivots further toward the U.S. or Asia, Europe will face diminished influence in the global stablecoin ecosystem. They might as well launch $POOR on pump.fun.

The Bigger Picture: A Clash of Philosophies

At its core, MiCA is Europe’s attempt to assert control and governance over Web3 and, in doing so, regulate it to death. Its strict compliance demands will stifle competition and innovation. Tether, with its decentralized ethos and focus on underserved markets, represents a challenge to this model.

Take Twitter with a grain of salt, and take Jacob Kring with a bucket of it.

I love stablecoins, Tether in particular, and I will be writing about the ongoing and ever-increasing future stablecoin war. Stay tuned for insights, drama, and analysis as it all unfolds.

P.S. In case you didn’t realize, I am not Patrick Hansen.