Tether’s Dominance; The Final Boss in Stabletown

Stablecoins are undoubtedly solidifying their role as one of the most transformative innovations in crypto. There couldn’t be a better (killer) use case. Recently, Artemis released an updated market map showcasing over 200 stablecoin-related players added in just the past two months. While this reflects the growing interest and innovation in the sector, the reality remains that there’s one clear leader in the room: Tether.

They may as well have added just one player. The point is clear; Tether, with its massive market share, continues to dominate the stablecoin ecosystem, leaving others far behind in reach, relevance, and trust. While the map is fascinating for its variety, it underlines a critical fact: few come close to the scale and impact Tether wields globally. And most of them will have run out of runway, patience and “founders” by the end of this cycle.

The Numbers That Matter

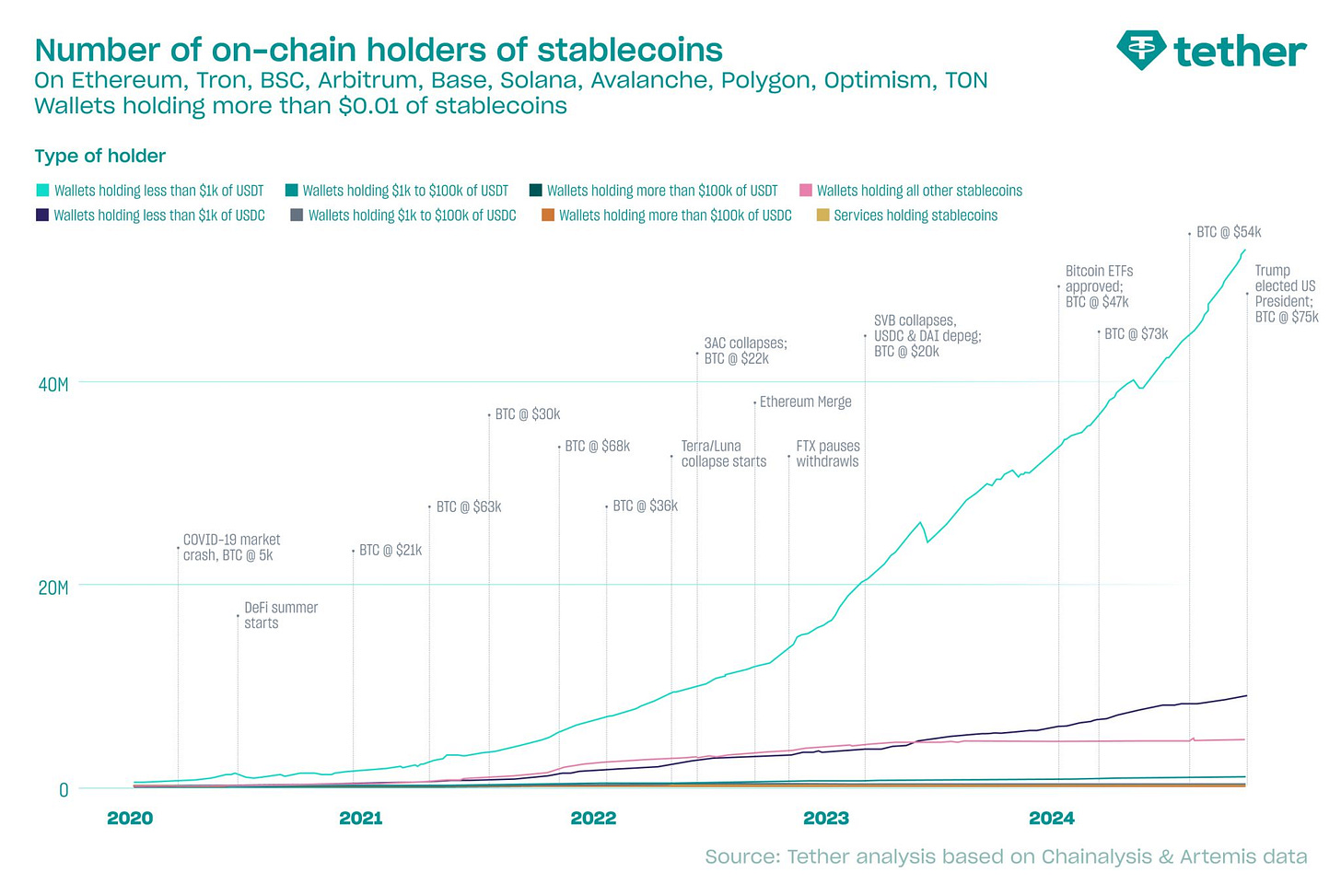

The Artemis stablecoin map visually emphasizes the sheer number of players entering or expanding their roles in this ecosystem, from issuers and wallets to infrastructure and remittance services. However, when it comes to the most critical metrics, market adoption, wallet penetration, and overall trust, Tether’s USDT stands unparalleled. Philip Gradwell, Head of Economics at Tether, recently shared some striking insights about USDT's adoption and its on-chain presence.

Recent data from Tether Insights Vol. 2 highlights:

330 million wallets have received USDT at some point, with a significant portion still actively holding it

4x more wallets hold USDT compared to all other stablecoins combined, cementing its dominance across blockchains

Its utility spans from microtransactions for underserved populations to large-scale treasury operations, bridging both ends of the financial spectrum

These numbers tell an exciting story. Tether isn’t just a player in the stablecoin game; it’s the core infrastructure powering millions of global transactions. It’s particularly fascinating that 18.7 million wallets hold between $0.01 and $1 of USDT, a clear indication that Tether serves the underserved, enabling access to financial systems for individuals who might otherwise be excluded. This focus on inclusivity is part of what sets Tether apart and strengthens its leadership position. It’s also where Circle shows its corporate fangs, trying to conquer a different part of the market; one of compliance and regulatory obedience.

The Competitive Landscape

While the landscape is diversifying, most new entrants and smaller players face the uphill task of achieving meaningful adoption. Even competitors with institutional backing, such as Circle’s USDC, are playing catch-up. Despite Circle’s regulatory alignment and its integration across compliant ecosystems, it falls behind on adoption in key growth markets.

Moreover, the narrative of USDC being favored by regulators, such as Coinbase's recent decision to delist Tether and other non-MiCA-compliant stablecoins in the EU, has further highlighted how Circle is positioning itself differently. While this alignment may benefit Circle in Western markets, it still fails to make a meaningful dent in Tether’s dominance globally, particularly in underserved regions.

Tether’s Global Reach - More Than Just Numbers

What makes Tether's position even more compelling is its mission. As Paolo Ardoino, Tether’s CTO, aptly highlighted in a recent interview

“Tether isn’t chasing Wall Street or European bankers; it’s focused on 3 billion unbanked people around the world.”

Tether’s dominance stems from this focus. While competitors battle for regulatory favor and institutional trust, Tether has quietly embedded itself into the financial lives of millions who need stablecoins the most. This grassroots adoption cements Tether’s lead in the stablecoin space and shows why competitors will struggle to replicate its success.

What Does the Future HODL?

The stablecoin market map released by Artemis is a testament to the rapid evolution of this sector, but it also illustrates that quantity doesn’t always equal quality. Many of the projects added to the map will struggle to find users or establish trust, leaving Tether with its dominant position intact.

Here’s why:

Tether’s ability to integrate across 10+ blockchains and support 97.5% of the total stablecoin supply is unmatched. It’s not just about issuing tokens; it’s about creating utility at scale, from emerging markets to institutional treasuries and being able to adopt at scale. Most of them will be scrambling

Because Tether has first mover advantage and early entrance into the stablecoin ecosystem it has a critical edge in establishing trust and credibility that competitors have yet to replicate.

While Circle’s USDC focuses on compliance, Tether remains pragmatic and action-oriented, often stepping in during crises to freeze funds and protect users. They’re also not pussies.

One Player to Rule Them All

Amidst the hundreds of logos and new projects of Artemis’ map, Tether remains the undisputed heavyweight champion. Their market share is unmatched, their adoption broad, and their grassroots focus keeps them leagues ahead of their competition.

New entrants will continue to challenge the status quo; the dominance of Tether underscores that being the leader in stablecoins isn’t just about having the best technology or regulatory alignment; it’s about serving the people who need it most. As the stablecoin map continues to expand with mildly funded projects, Tether’s presence will remain the benchmark against which all others are measured.

I love stablecoins, Tether in particular, and I will be writing about the ongoing and ever-increasing future stablecoin war. Stay tuned for insights, drama, and analysis as it all unfolds.

P.S. In case you didn’t realize, I am not Patrick Hansen.