What the Genius Act Could Mean for Tether: Between Compliance and Global Leverage

A new round of stablecoin legislation is on the table in the United States. And this time, it might actually pass.

During a Consensus 2025 side event in Toronto, Senators Cynthia Lummis and Kirsten Gillibrand expressed confidence that the Genius Act, a bipartisan stablecoin bil, could be approved by Memorial Day. Congressman French Hill echoed the sentiment, adding that both the stablecoin and crypto market infrastructure bills are being actively aligned for potential presidential approval before the August recess.

The Genius Act, which has undergone multiple revisions, is focused on clearer consumer protections, bankruptcy protections, and stricter oversight of both domestic and foreign stablecoin issuers. It is being created to address institutional and retail use cases, while “minimizing” systemic risk.

So, What’s at Stake for Tether?

Tether is the obvious elephant in the room. Although based offshore and operating outside U.S. jurisdiction, the company’s role in global dollar liquidity is impossible to ignore. As of today, USDT represents the vast majority of stablecoin volume across emerging markets, OTC desks, centralized exchanges, and even remittance corridors.

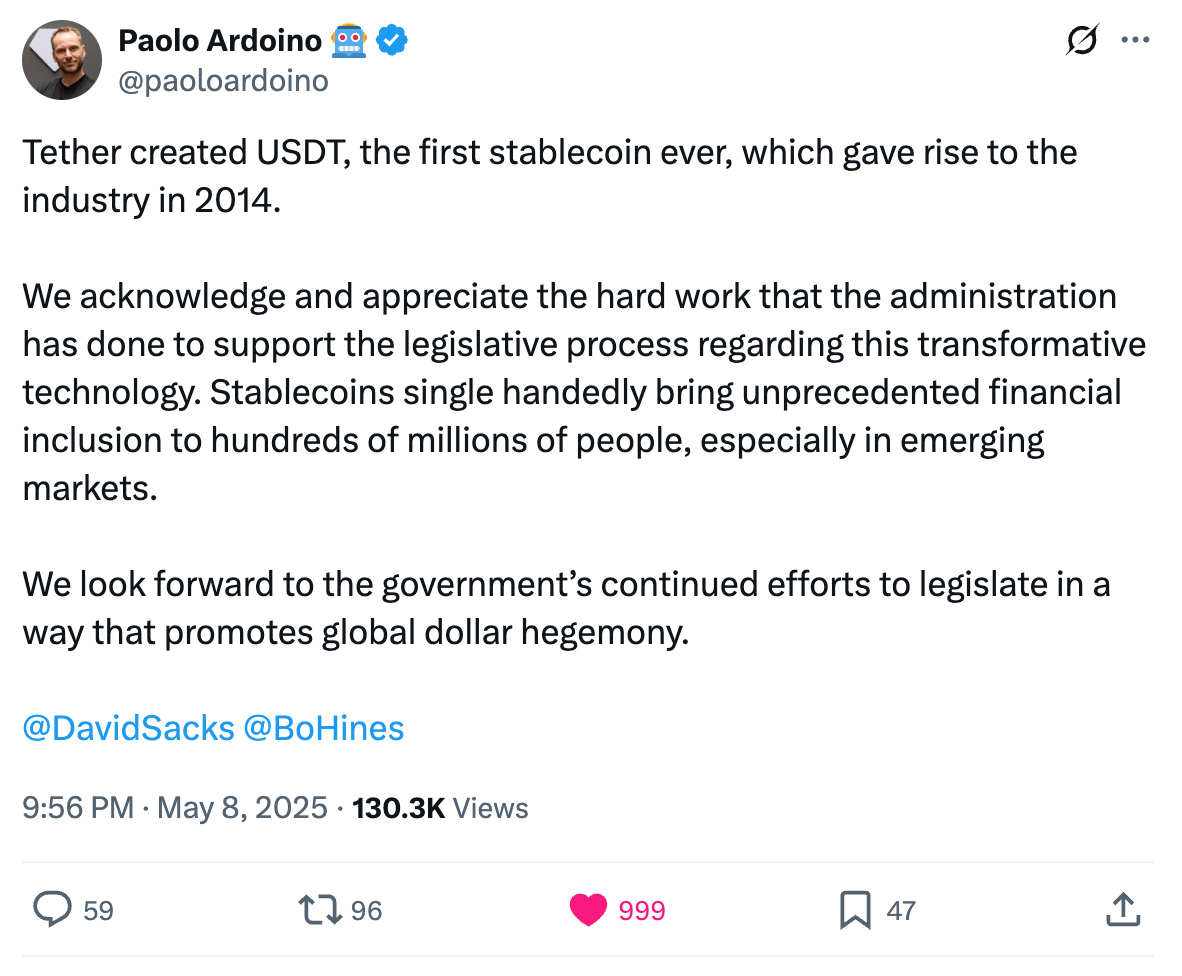

If the Genius Act passes, the U.S. will have a formal framework for approving and overseeing stablecoins. This means clear conditions for compliance, especially for those issued within U.S. borders. But it also means foreign stablecoin issuers like Tether will be formally categorized, and potentially restricted, in their interaction with U.S.-based platforms, payment channels, and financial institutions. Hence Paolo’s tweet:

https://x.com/paoloardoino/status/1920553400191643694

In short: the Genius Act may not outlaw USDT, but it will significantly limit its formal use in U.S.-compliant platforms.

Tether’s Options

Tether likely sees this coming. There’s been talk, including from Paolo Ardoino, about launching a fully U.S.-compliant version of USDT, like I predicted in my earlier articles. This could come in the form of a separate, ring-fenced stablecoin (let’s call it USDT2 again) issued under a U.S.-registered entity, backed by fully audited reserves, and meeting every provision the Genius Act might require.

This dual-rail strategy would let Tether maintain its global USDT dominance while carving out a compliant lane for regulated institutions to use in U.S. markets.

Meanwhile, offshore USDT continues to serve the needs of users in Argentina, Nigeria, Turkey, Southeast Asia, and elsewhere, where the demand for USD liquidity isn’t waiting on Senate votes.

Regulatory Narrative vs. Ground Reality

One of the most important takeaways from this bill is the emerging bifurcation in the stablecoin market. The Genius Act, if passed, will codify what is "legal" stablecoin behavior in the U.S. But outside its borders, USDT will continue to thrive precisely because of its frictionless nature. Cross-border payments, crypto-native trades, OTC commerce, and even dollar-denominated savings habits have already formed around USDT.

Even with potential restrictions, no other stablecoin comes close to matching Tether's market penetration. Circle’s USDC, despite being based in the U.S., remains highly dependent on compliant infrastructure, which limits its adoption in non-banked or high-inflation regions.

The Genius Act might be successful in creating a well-regulated stablecoin class within U.S. capital markets. But it likely won’t erase the market share Tether has amassed elsewhere.

The Trump Distraction

While Senators Lummis and Gillibrand made a point to decouple the Genius Act from the recent headlines surrounding Trump’s alleged memecoin and airplane-related controversies, there’s no denying the political tension. Senator Gillibrand called some of Trump's actions potentially illegal under the Emoluments Clause and expressed concerns about fraud and corruption.

This added layer of political noise could either delay the bill or force legislators to frame it even more strictly in order to appear above reproach. Ironically, this might create additional pressure to draw clear regulatory lines between sanctioned, U.S.-backed stablecoins and the rest of the market.

A Path Forward

The Genius Act is unlikely to ban Tether. But it will give U.S. regulators a clear framework to define what constitutes a "legal" stablecoin domestically. Possibly resulting in:

U.S. exchanges being required to delist or ring-fence USDT

Tighter banking and payment partner requirements

New compliance obligations for wallets and DeFi platforms that support stablecoins

In the end, Tether’s global strategy will remain intact. The Genius Act will draw a perimeter around what is considered legitimate within the U.S., but it will also sharpen Tether's messaging outside it: that they are still the most liquid, accessible, and flexible dollar proxy on the planet.

And in a world where the average user just wants to hedge against (hyper) inflation, that might matter more than any piece of legislation.

I love stablecoins, Tether in particular, and I will be writing about the ongoing and ever-increasing future stablecoin war. Stay tuned for insights, drama, and analysis as it all unfolds.

P.S. In case you didn’t realize, I am not Patrick Hansen